When you start down the rabbit hole of wine collecting, one term that frequently comes up is stored ‘in bond.’ But what exactly does this term mean, and why is it so significant in the context of wine investment?

In this article, we’ll bring you up to speed on the concept of ‘in bond’ wine, exploring its tax implications, storage, security, and provenance. We’ll also explain why it’s the preferred option for collectors and investors.

Understanding ‘In Bond’ Wine

Wines sold ‘in bond’ have not yet had customs duties and VAT (Value Added Tax) paid on them.

Essentially, these wines are in a state of financial and logistical limbo, where their tax status and final destination remain undecided until they are withdrawn for consumption.

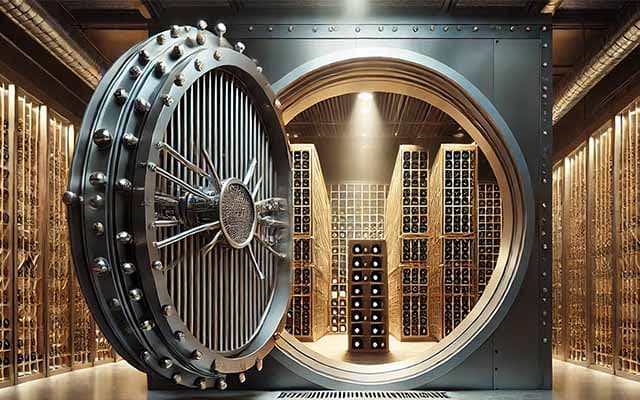

When purchased in bond, the wine is stored in a ‘bonded warehouse’—a government-regulated, authorized facility responsible for maintaining optimal storage conditions, complying with customs and tax regulations, and keeping accurate records to ensure the security, preservation, and traceability of the goods.

The Tax Implications of Buying ‘In Bond’

One of the most compelling reasons to purchase wine in bond is the deferment of taxes.

Typically, when wine is imported into a country, customs duties and VAT must be paid immediately. However, with in-bond purchases, these taxes are postponed until the wine is removed from the bonded warehouse.

This has important financial implications:

Deferment of Taxes: By deferring the payment of duty and VAT, you can allocate more of your funds to acquiring valuable wine rather than tying up cash in taxes.

Tax Efficiency on Sale: If you choose to sell the wine while it is still in bond, you avoid paying the duty and VAT. This is particularly advantageous if the wine’s value has increased, as it allows you to sell without the additional tax burden, making the wine more attractive to buyers.

VAT on Original Sale Price: If you eventually decide to withdraw the wine from bond, VAT is calculated based on the original purchase price rather than the current market value. Given that fine wine has historically appreciated over time, this can result in material tax savings.

Professional Storage and Security in Bonded Warehouses

The professional storage conditions provided by bonded warehouses are another key advantage of buying wine in bond.

These facilities are specially designed to maintain the ideal conditions for wine storage, including controlled temperature, humidity, and security measures.

Temperature and Humidity Control: Fine wine is highly sensitive to its storage environment. Temperature fluctuations, excessive humidity, or dryness can all negatively affect the wine’s aging process. Bonded warehouses ensure that these conditions are kept stable, preserving the wine’s quality over time. Rest assured, your wine hasn’t been stored under someone’s kitchen sink during the summer.

Security: Bonded warehouses are secure facilities monitored around the clock. This high level of security reduces the risk of theft or damage, providing peace of mind for investors who may not have the means to store their wine securely at home.

Government Regulated: These warehouses are authorized and regulated by government customs agencies, adding an extra layer of credibility and accountability. This government oversight ensures that the warehouse meets stringent standards for security and storage conditions, further protecting your investment.

Provenance and Authenticity

Provenance, or the documented history of a wine’s ownership and storage, is crucial in the fine wine market.

A well-documented provenance preserves a wine’s value and makes it more attractive to buyers. Wines stored in bond typically have a clear and traceable provenance, as their storage history is recorded from the moment they leave the winery.

Easier Traceability: When you purchase wine in bond, you can be confident that it has been stored correctly since it left the winery. This reduces the risk of buying wine that has been improperly stored or tampered with, which could affect its quality and value.

Higher Market Value: Because of the assured provenance and the optimal storage conditions, wines stored in bond often command higher prices in the secondary market. Buyers are more willing to pay a premium for wines that have been stored in bond, knowing that they are getting a product with high fidelity provenance.

The Process of Buying and Selling ‘In Bond’

Buying ‘In Bond’: When you purchase wine in bond, it is typically sold by the unmixed case, and you do not take physical possession of the wine. Instead, it is stored at the bonded warehouse until you decide to either sell it or withdraw it for personal consumption.

Selling ‘In Bond’: Selling wine in bond is particularly advantageous because the new buyer takes on the tax liability. This means you can sell the wine at a more competitive price, without the need to factor in the cost of duty and VAT.

Withdrawing from Bond: If you choose to withdraw your wine from bond, you will need to pay the applicable duties and VAT. However, as mentioned earlier, taxes are calculated on the original purchase price, not the current market value, which can be beneficial if the wine has appreciated in value.

Risks and Considerations

While buying wine in bond has many advantages, there are some risks and considerations to keep in mind:

Excessive Shipping: Storing wine in bond doesn’t guarantee that it has remained in the same bonded warehouse throughout its life. There is a chance the wine has been moved between multiple warehouses, increasing the risk of damage during transit.

Potential for Ullage and Seepage: Even in the best storage conditions, wines can suffer from ullage (a reduction in the wine level within the bottle) or seepage. These issues can occur during long-term storage and can affect the wine’s value and quality.

Summary

Buying wine in bond offers significant advantages for collectors and investors. From tax efficiency and professional storage to enhanced security and assured provenance, ‘in bond’ status helps protect the value of fine wine and makes it easier to manage a wine investment portfolio.

Whether you’re an experienced investor or just starting out, buying wine in bond is a strategy worth considering, offering a blend of financial benefits and peace of mind that’s hard to match.

Invest in Wine the Smart Way with BlockCellar

One of easiest ways to purchase wine in bond is through BlockCellar, a blockchain-enabled platform that simplifies the process of buying and selling highly sought-after wines & spirits. You’ll find the wines’ tax status under PBT Terms and Conditions.

At BlockCellar, your wine is stored in state-of-the-art bonded facilities like Octavian or London City Bond. These bonded warehouses are climate-controlled and monitored 24/7, ensuring that your valuable wine collection remains secure and retains its exquisite flavor and market value over time.

In addition, these facilities are equipped with backup power generators to maintain optimal storage conditions, even in the event of a power outage. To further safeguard your wines, all wines have comprehensive insurance coverage against breaks, leaks, and other potential damages. If something happens to your wine, the bottle is covered at the full replacement value.